المصدر: البريد الالكتروني 2011/11/22

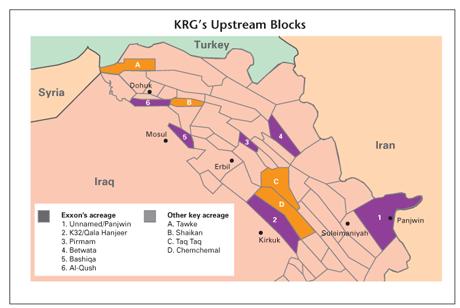

The map in the second article shows very clearly that KRG has extended its contracts to areas well within neighbouring provinces namely Ninewa, Kirkuk & Salah el-Deen.

Iraq's minister of oil Abdel Kareem Laibi, said yesterday on 20th Nov that Iraq is waiting for reply from ExxonMobil before the government takes a decision !

He did not specify how long his government is willing to wait ! According to Ameedy; DG of Licensing Dept., the ministry sent three letters to Exxon Mobil last month.

Issam

Exxon Mobil’s bold move into Iraq’s semiautonomous northern region of Kurdistan has provided the clearest evidence yet that a change is taking place within the US supermajor. A company renowned for its disciplined approach to strategy and investment is now demonstrating a hitherto unsuspected appetite for risk, and is taking bigger gambles and placing bigger bets in the quest for upstream opportunities (PIW Nov.14'11). "There’s a new Exxon in town,” says a senior executive with another major. “They’ve got a big war chest and are placing big bets. They’re clearly out to grab the resources first and decide how to make the money later." Pointing also to its recent Arctic alliance with Russia’s state Rosneft, the executive suggested Exxon was in some respects taking its cue from some of the larger national oil companies (NOCs) and smaller integrated rivals like Spain’s Repsol YPF and Italy’s Eni (PIW Sep.5'11). NOCs often take on enormous political risk to secure access to upstream reserves, while smaller integrated players frequently bet large on niche plays, as Repsol has done with great success in Argentina.The US supermajor’s shift in strategy seems to reflect a desire to grow. Since its 1999 merger with Mobil, Exxon has successfully maintained and strengthened its industry-leading position on returns. But there was little in the way of reserves or production growth until the December 2009 takeover of US shale gas specialist XTO Energy, in a deal that with hindsight seems to mark a watershed in Exxon’s recent history (PIW Dec.21'09). XTO marked the beginning of a series of gambits -- some successful, some not -- aimed at capturing growth opportunities in unconventional resources, Arcticand deepwater exploration, and LNG. Exxon was last year forced to abandon a $4 billion deal to acquire a stake in Ghana’s giant deepwater Jubilee field, but this year outmaneuvered both BP and Royal Dutch Shell to seal its alliance with Rosneft (PIW Aug.23’10). Exxon "doesn't have a great track record of finding oil, so maybe it's getting more aggressive in places where it knows it exists," one industry source notes, while analysts calculate that without XTO, Exxon’s reserve replacement last year would have been just 45%.Exxon's new approach also reflects a broader strategic rethink among the leading majors. For some time, the conventional wisdom among those companies has been that to secure the scale of reserves they need to replace production, they must focus on resource-access deals in countries such as Iraq and Russia. But after watching the success with the drill bit enjoyed by state firms like Petrobras and independents like Tullow and Anadarko, the majors are rediscovering a taste for exploration risk (PIW Sep.19’11). While even the new, more audacious Exxon would still at least consider all potential commercial, operational and legal repercussions before making any investment decision, the company's track record of avoiding messy political dustups and asset write-downs could be put to the test by its new strategy. Its move into Kurdistan, for example, clearly poses a threat to its relationship with Iraq's central government and to its West Qurna-1 contract. But while Exxon management is understood to be concerned that payment problems would erode the value of that deal, the price the company pays for doing business with Erbil may ultimately lie in the loss of future rather than current opportunities in southern Iraq. As one well-placed industry source told PIW, if Exxon really has burned its bridges with Baghdad, "it could miss out on other exploration down the road that could be more valuable." -------------------MON., NOV. 21, 2011

Kurdistan Starts Feeling The Exxon Effect

Exxon Mobil’s leap into Kurdistan has landed it with six exploration blocks and a looming row with the central government in Baghdad, which still disputes Kurdish oil rights in the absence of countrywide oil legislation. That the normally cautious supermajor jumped the gun on a political settlement between Erbil and Baghdad has already caused controversy, particularly given the contract Exxon signed with the central government in 2009 for the giant West Qurna-1 development. But the locations of Exxon’s Kurdish blocks reveal further surprises. Three of them -- Al-Qush, Bashiqa and K32 -- border or cross into territory disputed between Baghdad and the Kurdistan Regional Government (KRG), while a fourth abuts the border with Iran, an area where no acreage awards to US companies had been expected (PIW Nov.14’11). One of the two remaining more central tranches, Pirmam, is a “prize block ... always kept in reserve” and “at the center of a number of discoveries,” KRG Natural Resources Minister Ashti Hawrami told a CWC conference in Erbil last week. The three areas with the most potential are thought to be Pirmam and Betwata to the east for oil, and K32 for oil and gas. The other blocks are considered medium to high risk, although Al-Qush is adjacent to UKindependent Gulf Keystone’s Shaikan field.Exxon’s gambit has whipped up talk of a stampede into Kurdistan by other international oil companies. But the US firm's package of politically sensitive acreage underlines just how little is left, suggesting that its peers will have to focus instead on M&A and farm-in activity, including a possible move for the KRG’s back-in rights on existing licenses. There’s also likely to be competition from existing players, with Genel Energy, the new cash-rich independent formed from the merger of Turkey’s Genel Enerji and former BP boss Tony Hayward’s Vallares investment vehicle, on the hunt for more assets in Kurdistan (PIW Sep.12'11). Shaikan and Norwegian independent DNO's assets could prove the most attractive targets, with DNO’s Tawke field capable of reaching 200,000 barrels per day, but uncertainty surrounding Gulf Keystone’s claims that output from Shaikan could reach 400,000-500,000 b/d. Struggling minnows like France’s Perenco, the UK’s Sterling Energy and Canada’s Niko Resources all look vulnerable, as does the Dana Gas consortium developing the Chemchemal field, where work has progressed slowly in part because of the lack of a market for the field’s gas.Exxon’s deal already appears to have encouraged Baghdad to get on with finalizing Royal Dutch Shell’s gas gathering deal in the south, but it remains to be seen whether, as some are predicting, it will have the same galvanizing effect on oil sector relations between the central government and Erbil (related). KRG Prime Minister Barham Salih told last week’s conference that the two sides had agreed to increase exports from Kurdistan to 175,000 b/d in 2012 from 100,000 b/d at present, based primarily on anticipated higher output from the Tawke and Taq Taq fields. Salih added that the two sides had also agreed to work toward submitting a draft oil law to parliament by the end of the year, working from the February 2007 draft. But differences on revenue sharing could yet prove tricky to resolve, while any KRG desire to advance legislation -- and hit its five-year, 1 million b/d export target through the Kirkuk-Ceyhan pipeline -- will also hinge on political jockeying in Baghdad itself.

RSS Feed

RSS Feed